Support for Off-Shore Foreigner Start-ups

Why us, AIO?

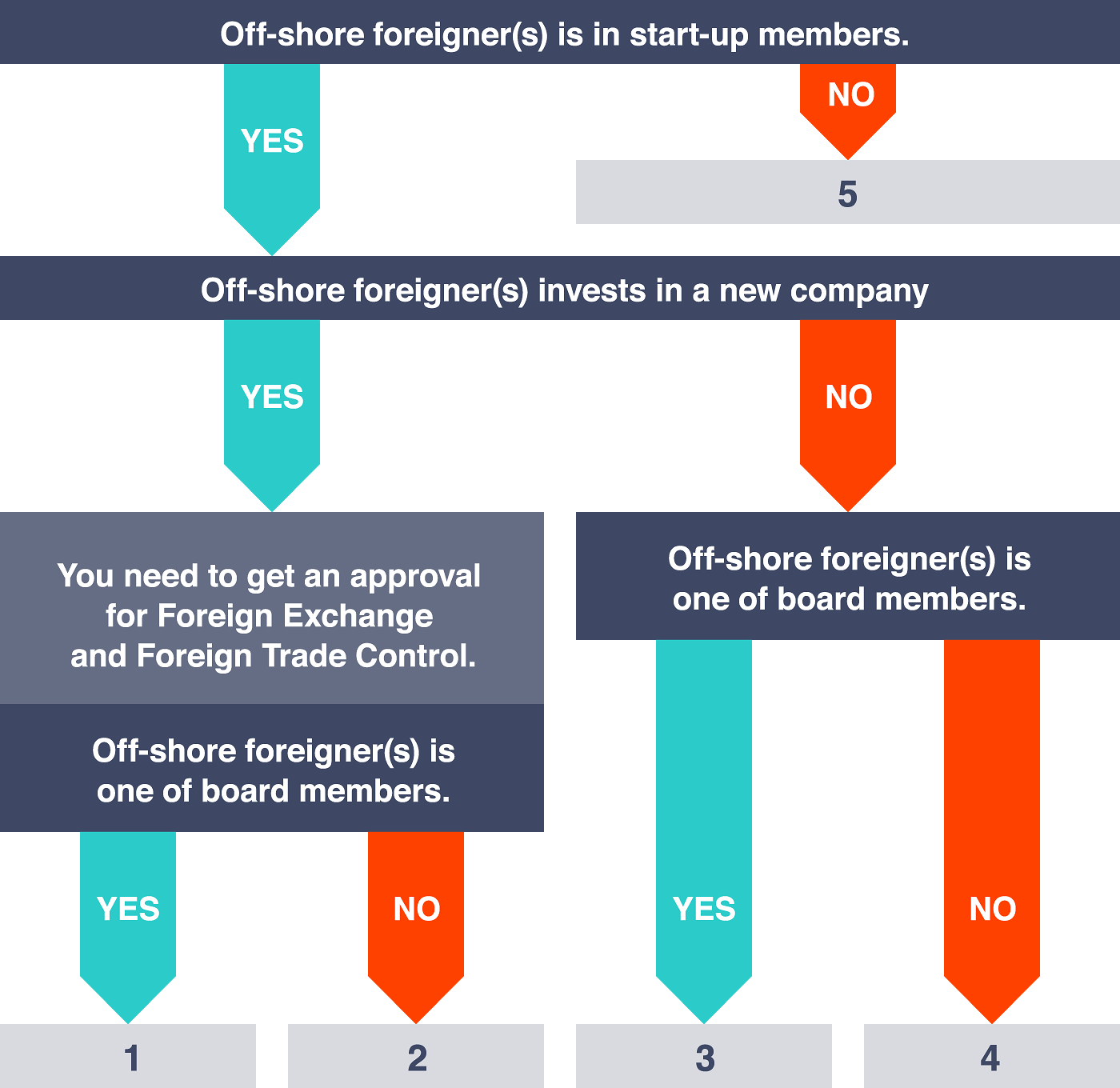

Check List before incorporating

1

Off-shore foreigner(s) invests in a new company and he/she is also registered as a board member of the company:

You need to prepare a certified signature, report to Bank of Japan, get a business visa, and so on.

We can help you for every matter! Call us for details!

2

Off-shore foreigner(s) invests in a new company but he/she is not registered as a board member of the company:

You need to prepare a certified signature, reports to Bank of Japan, and so on.

We can help you for every matter! Call us for details

3

Off-shore foreigner(s) does not invest in a new company but he/she is registered as a board member of the company:

You need to prepare a certified signature, gets a business visa, and so on.

We can help you for every matter! Call us for details!

4 & 5

Off-shore foreigner(s) does not invest in a new company nor is registered as a board member of the company:

Do you come and live in Japan to work for the company? If so, you need to get a business visa. We can help for your visa application!!

Flow to incorporate

【1】 Decision about basic matters

You have to initially decide Date of Incorporation, Company Name, Address of Headquaters, Business Purposes, Amount of Capital, Board Members, etc.

【2】 Articles of Incorporation

Every company has to regulate Articles of Incorporation which include the basic matters decided as in [1], total number of all issued shares, the fiscal year of your company and so on. To finalize Articles of Incorporation, it has to be certified by Notary.

Attention: In general, “Certified Stamp” is used in Japan. If you are resident in Japan, you can register a stamp with a city council where you live in. When being asked to stamp “Certified Stamp” for some documents, you use it attaching its stamp certification issued by the city council. If you are non-resident, “Certified Signature” certified by your own country is allowed to use.

【3】 Transfer Money (= Capital) to Japan

The company’s capital has to be transferred to a bank account in Japan. You cannot use a bank account in your own country.

Attention: The point here is a timing to transfer money. It must be AFTER you set up Articles of Incorporation. If you did transfer money before that, you need to move the money again. Bank fee must not be deducted from the amount of the capital.

AIO Professional Service

Our professional staff members, CPA, EA, and Licensed Social Insurance Consultants are ready to help you for Corporation Tax, Individual Tax, and Consumption Tax etc. .

Overall support about the tax practices and others for your company

Let us support you about the all tax practices in Japan as a good partner for you. We will confront problems you have together. When you do not know who to consult, simply contact us. You can visit, call, and/or email us. We have plenty of experience, knowledge and know-how to provide you a variety of plans for suitable tax planning (saving tax), tax risk reduction, corporate value maximization etc.

【Examples of our service】

・ Tax Advisor

・ Bookkeeping

・ Payment Procedure

・ Settlement of Accounts, Tax Report Draw-Up

・ Settlement of Monthly / Quarterly Accounts, Settlement of Consolidated Accounts

・ Financing, Fundraising

・ Cost Accounting, Managerial Accounting

AIO also has strong partnership with solicitors, attorneys and other professionals to help you. We are All In One to support you!!

Support for personnel and labor matters

Other than tax practices, we have supporting teams in terms of personnel and labor as well. We can provide you the most suitable service to meet requirements of each stage of your new company. You can take our advisory role and/or ask us for outsourcing. Our professional members are always happy to help you.

Procedures for Social Insurance and Labor Insurance

In Japan, there are two types of insurance system for employees: Social Insurance and Labor Insurance.

Regarding Social Insurance, it consists of health insurance and pension system. It is also OK for you (= an employer) to join the system. You have to get your employees in the system when the working condition has met the requirements.

Regarding Labor Insurance, it consists of unemployment insurance and accident compensation insurance. You (= an employer) must get your employees in labor insurance.

We can do all procedures about insurance systems on behalf of you. You can reduce time and workforce from the troublesome.

Outsourcing for payroll calculation

Generally, duties for payroll calculation have to be done in a limited short term, and allowance and deduction are complicated. In addition, because each law such as labor, social insurance laws and the income tax law are revised frequently, its work would be a big pain for you. There would be also a possibility that you may pay more premiums than enough since you do not understand complicated Japanese insurance systems. So, let us help you to be free from these troublesome and you can devote yourself to the company management.

Application for Subsidy and Bounty

There are variety of subsidies and bounties for start-ups and companies in Japan which are not necessary to pay off.

Most of grants require you lots of preparations and some conditions have to be met, and application period is very short usually.

We can advise you if there are suitable grants for you to run a company in Japan. We can also apply for them on behalf of you. The first consultation is not charged and feel free to ask us about grants.

Our Service Fee

Fee to incorporate a Limited Corporation

※We do not charge you to incorporate a company if you made a monthly advisory contact with us.

| Items | Fee (tax excluded) |

|---|---|

| Revenue Stamp to apply for Articles of Incorporation | Charge free because of e-application |

| Fee paid to JP government to get approval of Articles of Incorporation | YEN 52,000 |

| Registration and License Tax | YEN 150,000 |

| Fee to us, AIO | YEN 0 |

| Total | YEN 202,000 |

※Advance payment is necessary.

Note:

- Miscellaneous fees such as transportation and communication cost may be needed

- You can use “Certified Signature” certified by their own country. Its translation is needed. Our quote of translation fee is YEN 50,000 + tax or more.

-We can do extra optional jobs upon request.

-We can set up a Limited Liability Company too.

● 【Option】Report tax related documents to tax office and others

After your company is set up, many tax related documents have to be submitted to each tax office and other government representatives. We can submit all documents to be done on behalf of you.

| Fee (tax excluded) | |

|---|---|

| Submit documents to tax office and prefecture / city offices | YEN 20,000 |

※This is the fee when you make a monthly advisory contract with us

● 【Option】Procedure to join Social Insurance System (health insurance and pension)

After your company is set up, it may be necessary to join social insurance system. We can do every procedure to join the system on behalf of you.

| Number of Employees | Fee (tax excluded) |

|---|---|

| 1~9 people | YEN 20,000 |

| More than 10people | YEN 40,000 |

●【Option】Procedure to join Labor Insurance System (unemployment insurance and accident compensation insurance)

In Japan, an employer must get your employees in labor insurance system. We can do every procedure to join the system on behalf of you.

| Number of Employees | Fee (tax excluded) |

|---|---|

| 1~9 people | YEN 20,000 |

| More than 10 people | YEN 40,000 |

FQA

Q Can I, an off-shore foreigner, to set up a company in Japan?

A Yes, you can. If you live and run the business in Japan, you need to hold an available status of residence such as “Business Visa”. Consult us about your status of residence!

Q Can I, an off-shore foreigner, to be a promoter to set up a company?

A Yes, you can. There is no rules or regulations to limit an off-shore foreigner to become a promoter in Japan. Even if his/her ability is limited to accomplish a juristic act(s) in a law of his/her own country, it would not be the problem if Japanese law regards him/her as the abled.

Q Do I, an off-shore foreigner, need a certified stamp? What ID can I use when setting up a company?

A If your signature is certified by your country, its certified signature can be used instead of a stamp. Driving License, Passport, issued by your own country can be used as IDs

Q Can I, an off-shore foreigner, live in Japan to manage my newly set up company?

A If your visa does not have the certificate of eligibility to run the business in Japan, you need to change your visa status. Please keep in your mind that the fact of setting up a company does not always allow you to acquire the business visa.

Q Can I change my working visa to business visa because I want to set up a company?

A You can apply for the change of your visa status from working visa to business visa AFTER you ① set up a company ② submit all necessary documents to tax office and other government offices (③ employ staff members if needed). While you are preparing to set up a company, you yet cannot change your visa status. We can support for your visa application as well. Feel free to consult us!

Q How much is needed for the capital?

A Over YEN1 but it cannot be “zero”. Normally, there are many off-shore foreigners to register its capital over YEN 5,000,000 because they take into consideration to apply for his/her business visa in the future.

Q Is it OK to register my own house as the head office address?

A Yes, it is OK. If it’s a rented property, you need to make sure that there is no limitation in your rent contract. Check if it says “This property is only to live,” or “Business purpose usage is not allowed” etc.

Q What shall I do after setting up a company?

A Lots of paper works as below have to be done.

・ Report to tax office

・ Report to Prefecture Government Office

・ Report to City Government Office

・ Report to Social Insurance Office

・ Report to Labor Standards Inspection Office

・ Announce to Public Employment Security Office (so called “Hello Work” in Japan)

We can do all the above procedures upon request.